No, Devengo is not a bank, it’s a Payment Service Provider. While banks offer various financial services, PSPs specialize mainly in facilitating money movement and payment transactions. PSP is a legal entity providing payment services (e.g. issuing cards, acquiring payments, the authorization transactions) enabling the transfer of money between end users. Both (banks and PSPs) play important roles in the financial system, but their focuses and scopes are different, as is their regulation.

Verification - Valitic

Verify bank account holders in real-time

Streamline your payments and collections without compromising security: validate the bank account holders of your customers, suppliers, and employees instantly.

What is Valitic?

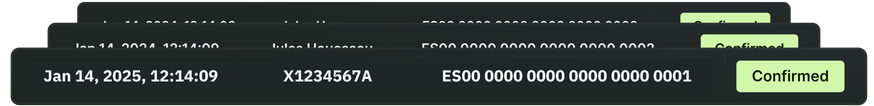

Valitic is the fastest, most secure, and modern way to verify a bank account holder verification in Spain. Developed by Iberpay and accessible through Devengo, this service allows you to check in real-time whether an account (IBAN) actually belongs to the person claiming to be its holder. No paperwork. No friction. No risks.

Protect your collections and payments against fraud, defaults, and identity theft.

Replace bank account holder certificates

Validate account holders with official, up-to-date data. No PDFs or manual processes.

Secure payments and reduce errors

Protect every payment, especially high-value ones, minimizing risks and chargebacks.

Continuous, frictionless service

Verify over 88 million Spanish accounts, with an average response time of 1 second, 24/7, 365 days a year.

Main Use Cases

Lead your sector with advanced verification technology - Reduce risks, avoid errors, and improve operational efficiency without adding complexity.

Digital Customer Onboarding

Eliminate onboarding barriers: validate instantly without user intervention and improve conversion.

Gaming and Gambling

Comply with regulations in high-risk sectors and streamline payments while improving player experience.

Recurring Payments

Avoid failed direct debits from the start in telecommunications, gyms, utilities, and subscriptions.

Insurance

Prevent defaults and fraudulent claims by verifying accounts from contract signing.

Batch Verification

Update and verify thousands of accounts massively with total confidence and accuracy.

Credit and Loans

Assess creditworthiness, prevent fraud, and ensure funds reach the correct account.

Experience the fastest, simplest, and most secure way to validate a bank account holder

-

Results in <1 second

-

Coverage of 99% of Spanish accounts

-

Available 24/7/365

-

93 integrated financial institutions

-

100% digital

POST

https://api.sandbox.devengo.com/v1/holder_verifications

REQUEST

{

"destination": {

"type": "iban",

"iban": "ES3969400001150000000001"

},

"recipient": "Devengo S.L",

"taxid": "B88353412"

}

RESPONSE

201

FAQs

-

Is Devengo a bank?

-

Where does Devengo operate now?

-

Is it necessary to create an account (IBAN) with Devengo to operate?

-

Is it necessary for my company and clients to go through an AML onboarding to operate?

-

How long does it take for a client to integrate our API?

-

Does Devengo offer card-issuing services?

-

Is Devengo offering its services through Open Banking?

-

Is it necessary for my company and clients to go through an AML onboarding to operate?

-

Can I create accounts in different currencies?

-

Can I create and orchestrate accounts for my clients?

-

What is a virtual IBAN?

-

Information on Commissions and Fees

-

What are Push Payments?

-

What are SEPA Instant Payments?

-

How do we help with automatic payment reconciliation?

-

What percentage of the Devengo Payments are delivered?

-

What percentage of the Devengo Payments are instant?

-

What are Pull Payments?

-

What is the Request-to-Pay scheme?

-

What is the difference between Payment initiation and Request to Pay?

-

When will SRTP be operational in Devengo?

-

How does Devengo's Account Access Verification service currently work?

-

In what countries will Devengo offer this service?

-

What is Valitic and how does it work?

-

How long does it take to verify account ownership with Valitic?

-

Is Valitic compliant with data protection regulations?

-

What sets Valitic apart from other verification services?

-

How can I integrate Valitic into my system?

-

What are the fees for using Valitic?

-

When will VOP scheme be operational in Devengo?

Let us find the best financial infrastructure for your case

We will offer you the solution that is most efficient and convenient to solve your money flows, whatever they may be. We’d love to hear from you.